Josh has extensive experience both on Wall Street as a trader and analyst for 15 years, and in developing software solutions through his current consulting business, Innovative Ops. We spoke to him about a process automation system he built for an insurance client, and how he integrated our PDF to Excel API.

PDFTables: So Josh, you’ve used PDFTables for one of your recent clients – can you walk us through the client needs?

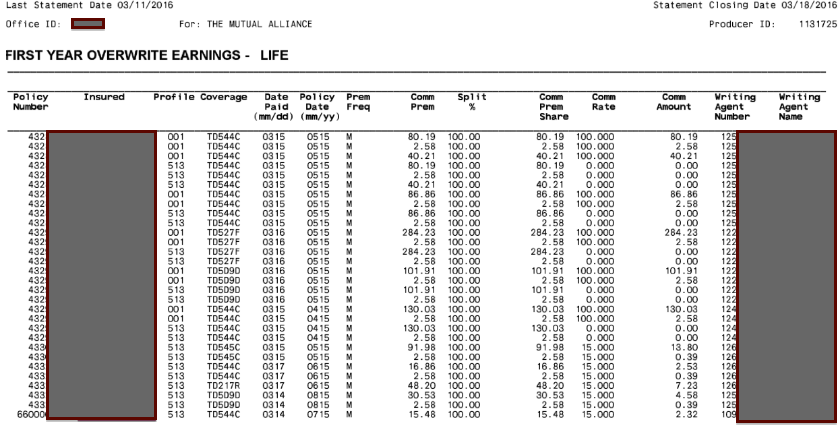

Josh: My client (The Milner Group) is a large insurance brokerage in Atlanta, Georgia, and it needed to streamline the way they processed agent commissions. These commission reports are sent to Milner as PDF documents and traditionally, they’d need to be entered manually into their CRM for processing.

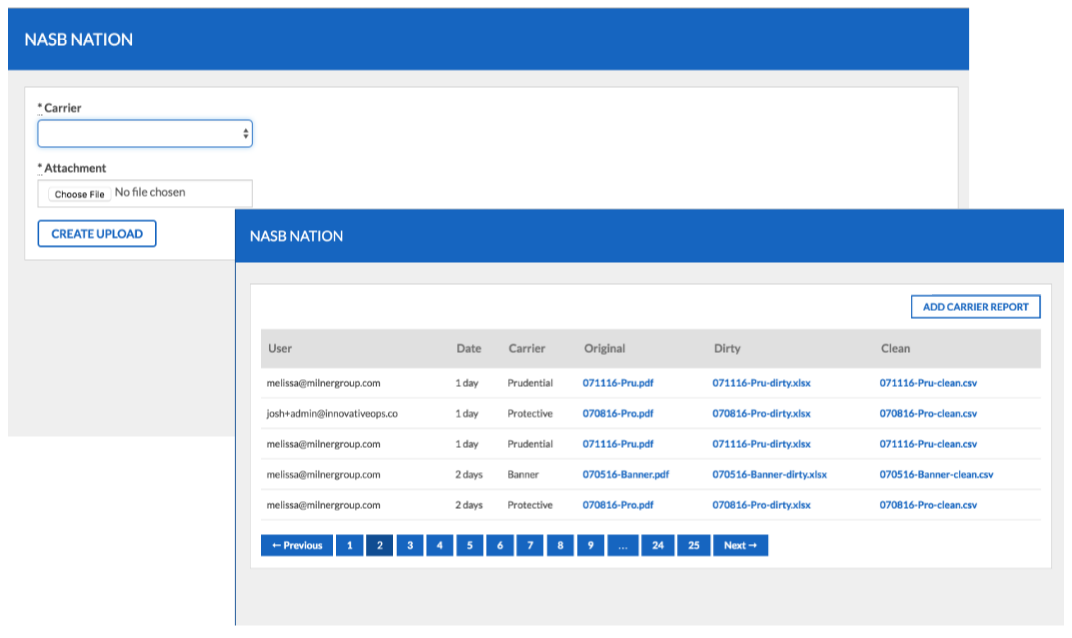

They needed a solution that would streamline this process, and recognised that the manual input stage was causing a backlog. I was brought in to devise a solution that fit with their CRM system, which was built with the ability to connect to other services via APIs. The client needed to be able to parse data from the PDFs, and they wanted a solution with a friendly API that would convert their PDFs to Excel spreadsheets for last-mile processing.

PDFTables: What made you choose PDFTables?

Josh: Initially, I had to decide between building a conversion utility myself for the PDF documents using existing conversion libraries, or working with someone who was already doing it commercially.

It was when I was researching the latter option that I came across PDFTables.

A lot of commercial products I found during my research put too much control in the end user’s hands, whereas the client wanted something that could be integrated under the hood, that could essentially run on autopilot with minimal intervention. Plus, some of those products weren’t even polished enough to present to the client.

PDFTables, on the other hand, seemed polished and reliable and when I discussed the project needs with Aine [Business Development] and Steve [Engineer] at PDFTables, they showed a real interest in the project. Some of the other products I approached either didn’t reply, or showed little interested in helping me.

The PDFTables team were very helpful and knowledgeable from the beginning. It gave me confidence that if I got hit by a bus, the client would be in good hands!

PDFTables: So how did you go about implementing the PDFTables PDF to Excel API?

Josh: Their bespoke application is built on Ruby on Rails, so for this project a Ruby implementation was the preferred route.

We wrote a Ruby on Rails app that calls the PDFTables API, runs a series of validation routines on the extracted PDF table, and produces a spreadsheet for each carrier that’s exactly in the correct format for the commission department. In just a few mouse clicks, their team is able to import the carrier data into their CRM system.

In my opinion, you guys have the ultimate service. It's really simple to understand from a developer’s perspective and it plugs in nicely to what you’re building and allows the flexibility that you need.

PDFTables: What was the client’s view of transforming their processes with this kind of automation? Were there any concerns?

Josh: In the early stages, I worked with the commission department’s Operations Manager on the process. She was actually one of the people who had recognised the need for automation.

However when we actually pitched the PDFTables solution, the staff who’d actually be taking advantage of this new process day-to-day were hesitant to change their role and the way they worked. I guess they felt like they’d be losing something if part of their job was suddenly automated.

That all changed when we put together a demo of the PDFTables-powered solution - they jumped on the automation bandwagon very quickly once they realised they would have more time to focus on their other priorities.

PDFTables: A reluctance to automate parts of people’s jobs seems to be a common theme in business nowadays - have you found this with other clients?

Josh: When I was in my Operations Officer role at the specialty life insurance company, I had the opportunity to improve the business processes. I was able to test my ideas and make the value call on how people's time would be reallocated. That meant I could just dive in and take the risks, try out the implementation and then talk to my staff about how their roles were going to change and get their input.

When it comes to my clients though, a number of them don’t tend to have people with my development background, so they can’t take those risks or make those value calls. That’s one of the reasons they bring someone like me on board.

However, the reality is that I'm not sitting inside their operation every day, so they also need to learn to embrace this concept of process automation in their own time, starting with management, and passing that open-mindedness down to the team members.

I’ve even had a big budget project where we finished the implementation,

they said thank you, I walked out and then never heard from them again,

and they never ended up using it. So they spent tens of thousands of dollars

on this digital transformation project, and never even used what we built!

It was as if we’d given them the keys to a new car, and they never drove it.

As a result, I've been building upon each experience and ensuring that these

steps are communicated with the client during the consultation, and

making sure they know how to use their new tools in the organisation.